- Community

- Departments

- Accounting

- Public Notices, Agendas, & Minutes

- Appointed & Elected Officials

- Assessing Department

- Building Department

- Census Information

- Clerk’s Office

- Federal, State & County Officials

- Fire Department

- Forms & Applications

- Open Space Preservation

- Ordinances

- Planning & Zoning

- Senior Center Events and Recreation Events

- Supervisor

- Treasurer’s Office

- How Do I…

- Records

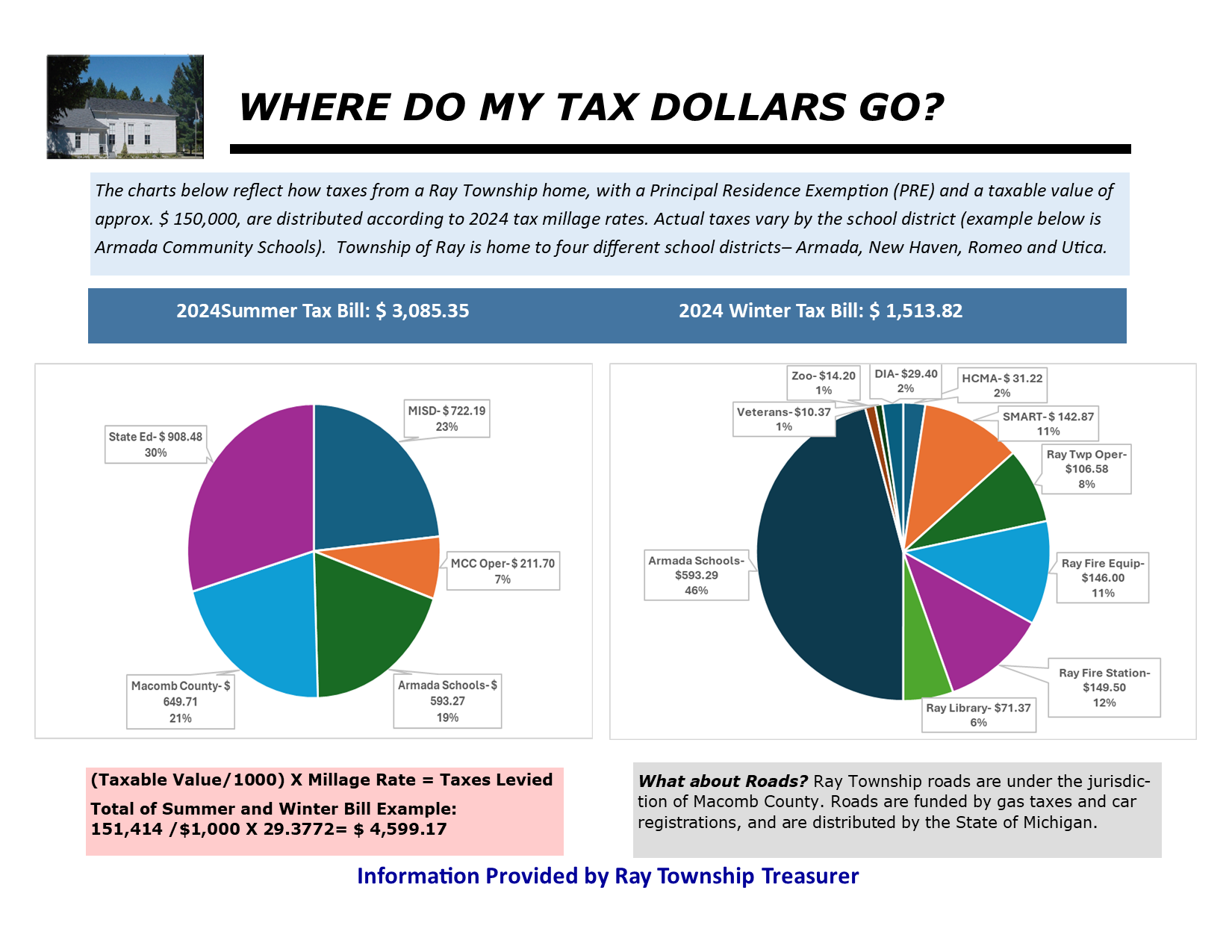

Treasurer’s Office

Tax Billing Dates

Summer Taxes - Summer Taxes are mailed out July 1st, payment deadline is September 14th.

Winter Taxes - Winter Taxes are mailed out December 1st, payment deadline is February 28th.

Unpaid Summer and Winter 2024 taxes are considered delinquent on March 1st and will be forwarded to the Macomb County Treasurer for collection. Macomb County Treasurer, 1 South Main St., Mt. Clemens MI 48043. Call (586) 469-5190 for amount to be paid. Delinquent payment must be sent to Macomb County Treasurer. The County will charge a 4% penalty plus 1% interest for each month until full payment has been collected.

If you do not receive your bill, please contact the office and we will send you a duplicate copy.

NOTE: Failure to receive your bill DOES NOT exempt you from any interest or penalty being applied, per Michigan compiled laws. It is the property owner’s responsibility to know taxes are due and payable.

Application for Deferment of Summer 2025 Taxes

Application for Deferment of Summer Taxes

Online Payment

We now accept VISA and MASTERCARD and DISCOVER for payment of property taxes.

Click HERE to make an online payment.

A CONVENIENCE FEE of 3% on the total amount charged, will be charged to the bearer of the VISA, MASTERCARD, and DISCOVER card.

After the last legal business day for tax collections, the Macomb County Treasurer will collect all delinquent taxes. Please call Macomb County Treasurer's Office for delinquent tax information, at (586) 469-5190.

To Calculate Taxes

For a home in the Romeo School District with a Taxable Value (TV) of $100,000, with a Principal Residence exemption, the taxes would be calculated as such:

Summer 2024 taxes: 100 (per $1000 of TV) x 21.16490= $2,116.49

Dog Licenses

Dog license applications are available at www.macombgov.org/departments/animal-control/dog-license-information. Applications must be mailed or taken in person to the Macomb County Animal Shelter, 21417 Dunham, Clinton Township, MI 48036. The Animal Shelter phone number is (586) 469-5115.

Staff

Betsy Bart Treasurer

treasurer@raytwp.org

Robin Fortuna Deputy Treasurer

Contact

(586) 749-5171

Ray Township

c/o Betsy Bart, Treasurer

64255 Wolcott, Ray Township MI 48096

TAX EXPLANATIONS-LOOKING AT

Macomb County Debt: Funds owed to Macomb County

Huron-Clinton Metro Authority (HCMA): These funds provide Huron Clinton Metropolitan Authority with resources for capital improvements and operation of county parks. This Act 147 of Public Act 1939 passed in November 1940.

SMART Bus: These funds are for the Suburban Mobility Authority for Regional Transportation. This service provides curb-to-curb pick-up with advance notification and is open to the general public, approved by voters in August 2006.

Ray Township Operating: For the day-to-day operations of the Township

Ray Township Fire Operating: For the day-to-day operations of the Township Fire Department. Year 1992.

Ray Township Fire Equipment: For upgrading and replacing the Township Fire Department equipment. Year 1991.

Ray Township Fire Station: For constructing and equipping a new fire station. Voter approved 2024.

Ray Library: This millage provides Ray Library with the funds needed to conduct their daily operations, etc. Voter approved in November 2006 and March 2020.

YOUR TAX BILL

School Operating: These funds are used for the day-to-day operation of the school district. Examples are: supplies, equipment, salaries, benefits and utilities, etc.

School Debt: Voter approved millage of the school district, for construction, land acquisition, improvements or specific projects. This millage cannot be used for salaries, benefits or any operating expenses.

School Supplemental/Sinking: This voter approved millage is used strictly for building repairs, brick and mortar projects. This is another millage that cannot be used for salaries, benefits or any other operating expense. This doesn't apply to all school districts.

Zoo Authority: These funds are used to cover expenses of the Detroit Zoo, which voters approved at the primary election of August 5, 2008.

Veterans: These funds are used to aid Macomb County veterans, which was passed at the regular election of November 4, 2008.

DIA: These funds are used to fund the Detroit Institute of Arts. Voters approved this millage on November 6, 2012.

*Some School Districts may have extra millages not listed. Please read your tax bill and call with any questions.

| 2024 Summer Property Tax Millage Rates: (millage rates are based per $1000 of Taxable Value) |

|

|---|---|

| Utica School District (50210) | |

| Principal Residence Rate | 18.20890 |

| Non-Principal Residence Rate | 27.20890 |

| Romeo School District (50190) | |

| Principal Residence Rate | 21.16490 |

| Non-Principal Residence Rate | 39.16490 |

| Armada School District (50050) | |

| Principal Residence Rate | 20.37720 |

| Non-Principal Residence Rate | 29.37720 |

| New Haven School District (50170) | |

| Principal Residence Rate | 20.58890 |

| Non-Principal Residence Rate | 29.58890 |

| 2024 Winter Property Tax Millage Rates: (millage rates are based per $1000 of Taxable Value) |

|

|---|---|

| Utica School District (50210) | |

| Principal Residence Rate | 7.82980 |

| Non-Principal Residence Rate | 16.82980 |

| Romeo School District (50190) | |

| Principal Residence Rate | 6.429819 |

| Non-Principal Residence Rate | 6.429819 |

| Armada School District (50050) | |

| Principal Residence Rate | 9.9982 |

| Non-Principal Residence Rate | 18.99820 |

| New Haven School District (50170) | |

| Principal Residence Rate | 10.20980 |

| Non-Principal Residence Rate | 19.20980 |